CMX 2025

Elias Haddad, Global Market Strategist at Brown Brothers Harriman, delivered a very sharp, wide-ranging briefing on what’s really moving global markets at CMX this month. Here’s what matters:

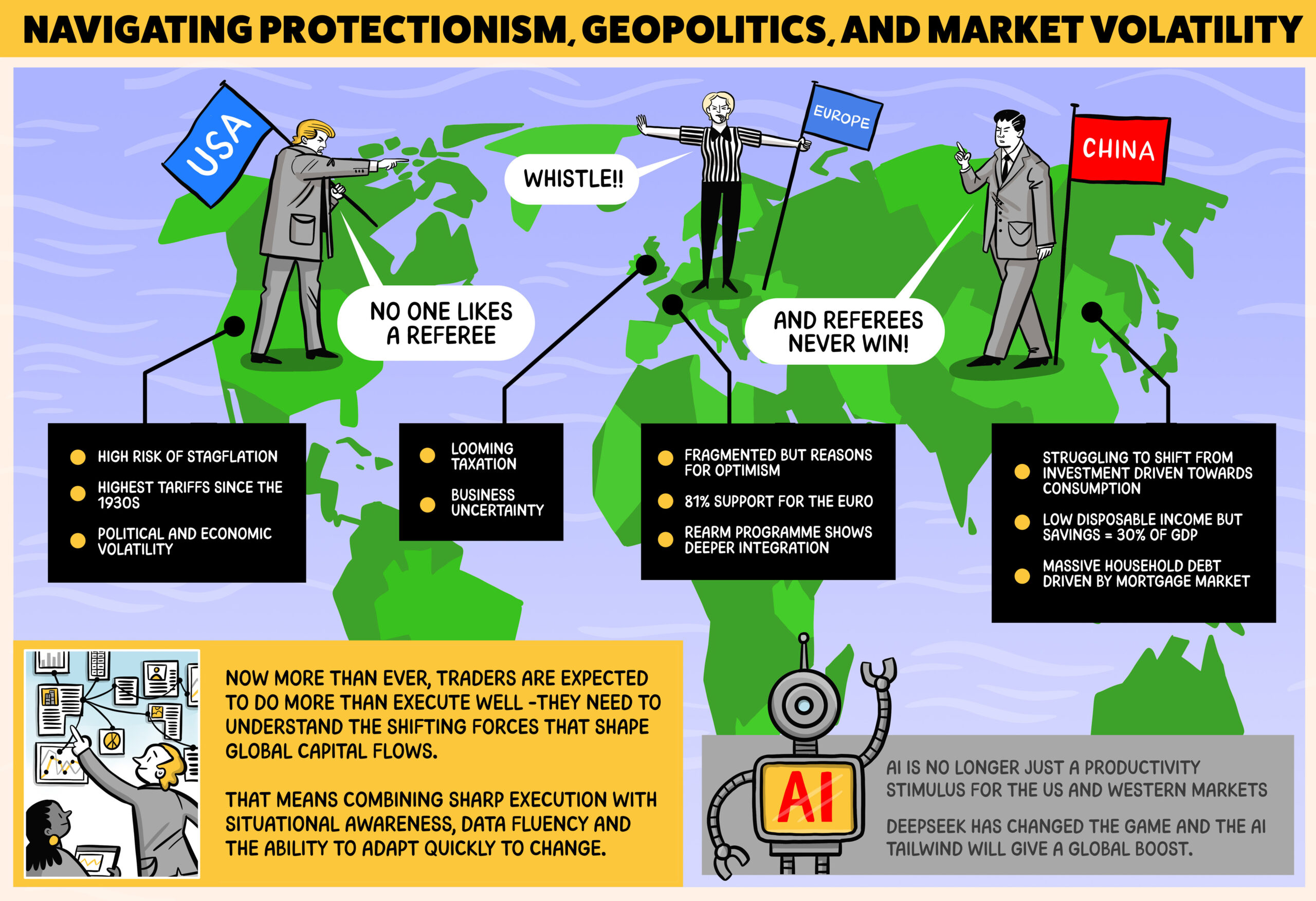

1. The bond market is Trump’s real opposition

Forget Congress. When volatility peaks, it’s not the Fed or political blowback that reins in the chaos—it’s Treasuries. April’s “Liberation Day” tariffs triggered a bond selloff so sharp it forced a White House pause. Harad reminds us: the bond market still calls the shots, and traders should keep one eye firmly on rates as the real constraint on fiscal brinkmanship.

2. Stagflation risk is real and rising

Trump’s tariff regime has lifted effective US tariff rates from 3% to 16%, the highest since the 1930s. That’s protectionism on steroids. The consequence? Downside risks to growth and upside risks to inflation. Harad’s base case: the US is edging toward stagflation. That bearish dollar view he holds? It’s rooted in a macro mix that’s looking increasingly toxic.

3. Europe’s integration story is being priced in (slowly)

Despite its fragmented setup, the Eurozone is inching toward fiscal union. The €800bn ReArm package, backed by common debt issuance, isn’t just a political signal, it’s a structural shift. Harad is structurally bullish on the euro and dismisses populist threats. Why? Support for the euro is at 81%, and even the political firebrands know it.

4. China still can’t quit investment, but a revaluation could change the game

Beijing’s failure to pivot to consumption has three roots: weak disposable income, high savings, and mortgage-heavy household debt. But Harad sees a possible out in renminbi revaluation. It would act as a subsidy for consumption and support rebalancing. A deal with Washington tying renminbi revaluation to US dollar weakness could unlock benefits on both sides and change the trajectory of trade risk.

5. AI’s productivity boost is no longer a US-only story

The expectation was that America’s AI lead would mirror the 90s internet boom. That’s now less certain. As Harad sees it, the game-changer is the rise of open models like DeepSeek and the productivity boost is going global. The result? A more level playing field, and less of a US equity monopoly on tech-fuelled optimism.

Bottom line:

This isn’t a market driven by sentiment. It’s a market driven by constraints—bonds, tariffs, demographics, and geopolitics. But the clearest call from Harad? Be wary of a US stagflation scenario, and keep a closer watch on policy-led currency shifts, not just central bank rate cycles.

The world of CMX

Unpack more insights in our CMXtra podcast!

In our latest podcast episode, we’re joined by Ash Sharma, Trading Analytics Manager at Aviva Investors and Sven Rudolf, Head of Trading, Fixed Income at ODDO BHF Asset Management, delving into all things data— the fuel and the challenge of modern trading…