At the Equities Hive event held in London earlier this year, buy side traders and London Stock Exchange Group participants discussed opportunities for accessing liquidity at a time of changing market structure

Accessing equity market liquidity remains a significant challenge. It’s a problem of complexity as the regulatory divergence between the UK and Europe compounds the fragmentation of the marketplace, raising costs and operational difficulties for traders.

Faced with a complicated and decentralised market, the buy side is focusing on finding liquidity in the right place at the right time.

At the Equities Hive London event, we set out to help buy side participants understand how they can utilise the full range of London Stock Exchange and Turquoise order books to access available liquidity.

For buy side traders, it can be hard to keep track of all the sources of liquidity in what’s become a multi-faceted fragmented market structure. While increased decentralisation continues to bring innovation to the market, it also means that traders need a greater variety of technology and skills to access the different liquidity sources – not to speak of forming bilateral agreements with a range of providers.

Positive liquidity surprises from Turquoise Plato Block Discovery™

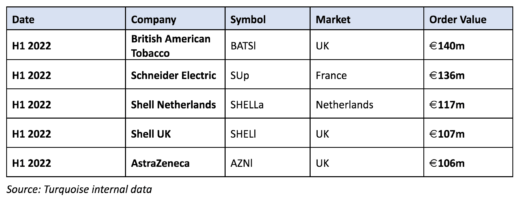

Often the buy side is not aware of the amount of latent liquidity available on Turquoise Plato™. Yet, there are much larger orders than is often realised. Taking Turquoise Plato Block Discovery™ as an example, we see a large amount of untapped liquidity. We regularly receive orders that exceed €100m on the platform. In fact, on the basis of receiving both large conditional and firm orders into the platform we increased our maximum conditional order entry size to €200mn.

Largest orders receiving at least a partial fill in H1 2022

The message to the buy side is: if you are going to trade blocks, go large. That’s because we observe in practice that liquidity begets liquidity. Often, we find that a large trade is followed shortly after by another large trade, creating clusters of follow-on block liquidity. But when appropriate, going large to start with would have created an opportunity to potentially find blocks in their entirety in the first place, taking real opportunity cost off the table.

Tools to empower the buy side

Beyond simply being aware of potential liquidity, Turquoise has now designed a new data workflow to communicate directly to the buy side the block activity that is taking place on Turquoise Plato™. The innovation was launched as a proof-of-concept, after Turquoise Plato™ worked in partnership with OpenFin, the market operating system. Flextrade Systems then became the first execution management system to integrate the workflow with others in-flight to follow. Earlier this year, the Turquoise, FlexTrade and Openfin partnership to collaborate efforts to improve the buy side trading desktop won the Financial News Financial Technology Innovation of the Year Award.

Turquoise Plato™ block trades are communicated direct to traders’ blotters, with options for alerts and automated workflows. This information empowers traders to make better decisions, especially in terms of capturing clusters of block liquidity.

Demystifying costs at the close

Turning to the London Stock Exchange closing auction there is a common misconception. that the cost of trading at the close is more expensive to trade at the close than at other times of day. Yet this is not the case. Traders can be reassured that there is no additional fee for accessing this important liquidity event at the end of the trading day.

After the official primary market closing auctions have completed, Turquoise Plato Trade At Last™ extends undisclosed block trading until 16.45 (UK time) offering the chance to find strategic dark block liquidity at a known price which is the well-formed official close price of the underlying market. Buy side participants were interested to discover better insights on accessing the post close mechanism and the different use cases for participation, especially how brokers are automating access to the service.

Concluding thoughts

At a time when the market is as fragmented as ever, this Equities Hive dialogue helped to foster greater understanding of the value of the London Stock Exchange central limit order book at the heart of the market for price formation.

The event also allowed us to explain how Turquoise Plato™, along with the new Turquoise Plato™ block notification straight to desktop innovation, can deliver greater insights. Traders were also pleasantly surprised by the low cost of trading at the closing auction – an important liquidity event at the end of the trading day.

Overall, the roundtable participants gained a better appreciation of how it can utilise the different trading mechanisms to access the exchange’s full potential liquidity, through strategic block trading and having tools for analysing liquidity and information that can empower them. Ultimately, refining the search for liquidity results in best execution, so improving performance for end investors.

In partnership with: