The luxury shopper has evolved – in both expectation and behaviours – and the need to provide a unique, memorable, and defined journey to consumers is vital to the survival of luxury brands. Whether in-store or online, the experience of luxury shopping must be outstanding from discovery to order fulfilment. Brands and retailers must have a clear understanding of who their customers are, what they want and how to communicate with them.

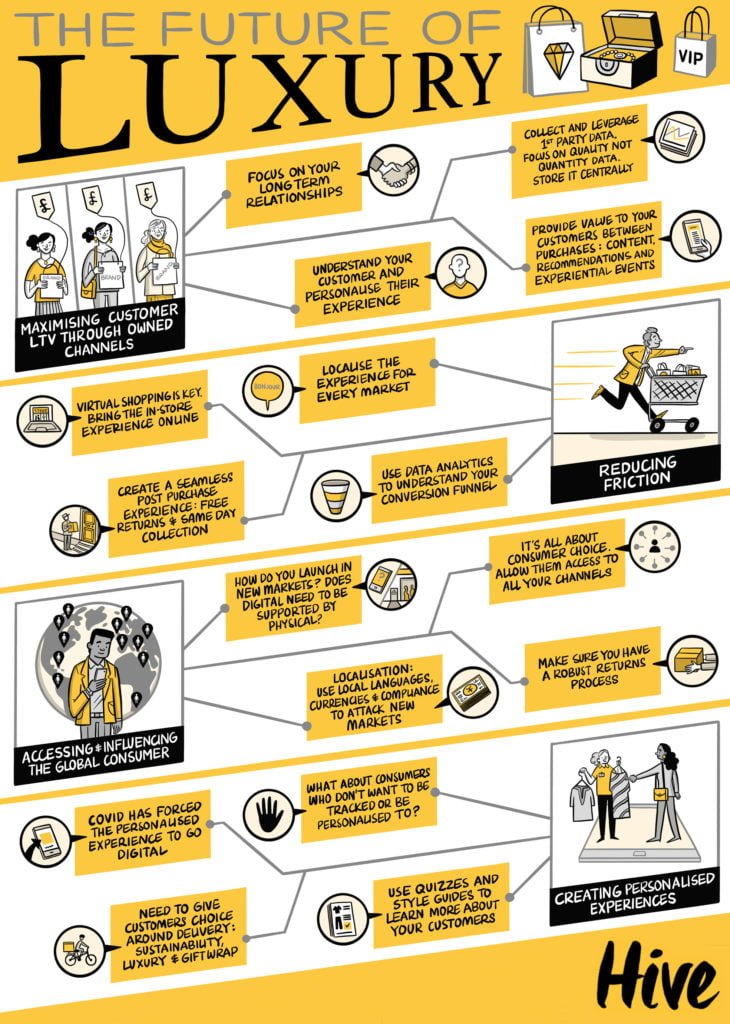

At our recent Future of Luxury meeting we hosted retail leaders from the luxury sector to combat some of the biggest challenges being faced within this field. With four roundtable topics focusing on various focuses within luxury retail, the conversations were vary varied and covered such a wide range of topics, but as always, there were some key trends that shone throughout.

Check out our newest scribe below highlighting some of these key trends, as well as the individual takeaways from the roundtable discussions… Enjoy!

Key Takeaways

Creating Personalised Experiences

- Pre Discovery is as important as “post survey”

- Personalisation digital – the need to give consumers the opportunity & reason to log in and interact, playful ‘games’ to data collect

- How can we personalise customers who won’t login?

- Personalise delivery options – Eco Packaging; slower deliver – for eco-conscious consumers

- Understand your clients needs (preferences) at each experience phase

- From product knowledge to client centricity

- It is getting harder to create an online personalised journey with GDPR and cookie changes – we must now find ways to overcome this

- Finding the balance of using partnership in certain territories

- Personalisation must be authentic both to the person and the brand

- Authenticity vs brand value for customer

- Focus on differentiating between digital and physical customer experiences

- How can brands express authenticity without being too corporate?

- How can personalisation become more of a 2 way dialogue?

- To offer a truly personal experience it must be more human – more nuanced than A.I

- Storytelling should be authentic to the brand

- Personalised content based on journeys can go wrong

- The future of personalisation is not data input but person centred output

- Personalisation is about all channels not only product related

- Personalisation gone wrong is worse than a non personalised experience

- Personalisation = engagement (on the whole)

Reducing Friction

- Virtual/chat functionality is a great benefit

- Mobile checkout ease, payment solutions, trust

- Localisation is paramount – payments/experiences/culture

- Removing frictions means identifying problem points and interpreting low risk solutions

- Payment options increase exclusivity

- Different spending habits of Millennials vs Gen Z – £ spending is more

- Payments providers are driving millennials to luxury brands but not driving AOV

- How do we open up ethical and effective payment methods for Gen z to make luxury sector possible?

- Affordability is a barrier to entry for luxury brands

- Generational behaviours

- Improving conversion balanced with net driving ‘irresponsible’ spending, important to balance especially with gen z

- eCommerce and physical retail should work together

- There’s still challenges connecting omnichannel – how do we tie it up?

- Virtual shopping tools are key to improving experience and reducing friction

- Aligning software between store and online is key to reducing friction

- Understanding conversion funnel is super important

- “Real” omnichannel

- eCommerce commissions

- Tech rollouts across key territories is important

- Mobile check out needs to be easy

- Payment solutions and trust are so important

Accessing and Influencing the global consumer

- Globalisation comes from setting the basics of omnichannel

- Find out if your customers are digital first

- Speak-easy types of access to brand experience

- Consumer expectations in the US Vs. rest of world

- Importance of omnichannel

- Digital Exploration before physical expansion

- To be a true global brand, be globally consistent

- Can we grow or launch a brand in new markets by digital only channels?

- Digital launch first before retail localisation(USA) operations opportunities

- Solve local customer ‘problem’/reasons why?

- Launch digitally first

- Local specificities are critical to get right

- Personalised experience depending on location

- A brand can be global but still have to create a localised experience

- For a ‘small’ brand it is important to use cost efficient digital tools to approach new markets

- Adapting brand storytelling and arrangements to different markets without losing the core brand identity

- Brands compete globally but consumers remain mostly local

- Not necessarily a choice between a global or local approach

- Should eCommerce be managed by a third party?

- New markets – can you be eCommerce led or do you need physical stores too?

- There is an ability to serve top experience by territory

Maximising Customer LTV

- Understanding the bridge between Online consumers and in-store experiences.

- Critical to become less dependent on 3rd parties and maximise customer data

- Nurturing owned channels is vital

- Markets Vs Regulation + the seamless journey from a customer POV.

- Multiple users and devices usage can make understanding data more complex

- Bridging the gap between online and instore is key

- Capturing data is more complex and expensive so looking at alternative solutions is key to moving forward

- The importance of closely aligning with your partners to remove friction from a CX, commercial and demand perspective

- Customer value does not mean spending value, make your customer an advocate

- Not only consider the customer LTV but also the reference value

- More of a statistical focus on your best clients spends meaning with people

- Partner events work well for high net worth individuals

- How do you determine the effective budget split in acquisition vs retention

- Data vs. insight

- Limited luxury industry maturity

- How to reduce friction between outline data and consolidation within new data purchase

- Have we understood the impact of poor use of data on consumer LTV?

- Retention vs acquisition – where should spend be prioritised?

- Focusing on client retention through exclusive vip offers

- How should we educate industries on how to grow LTV and how do we calculate it?