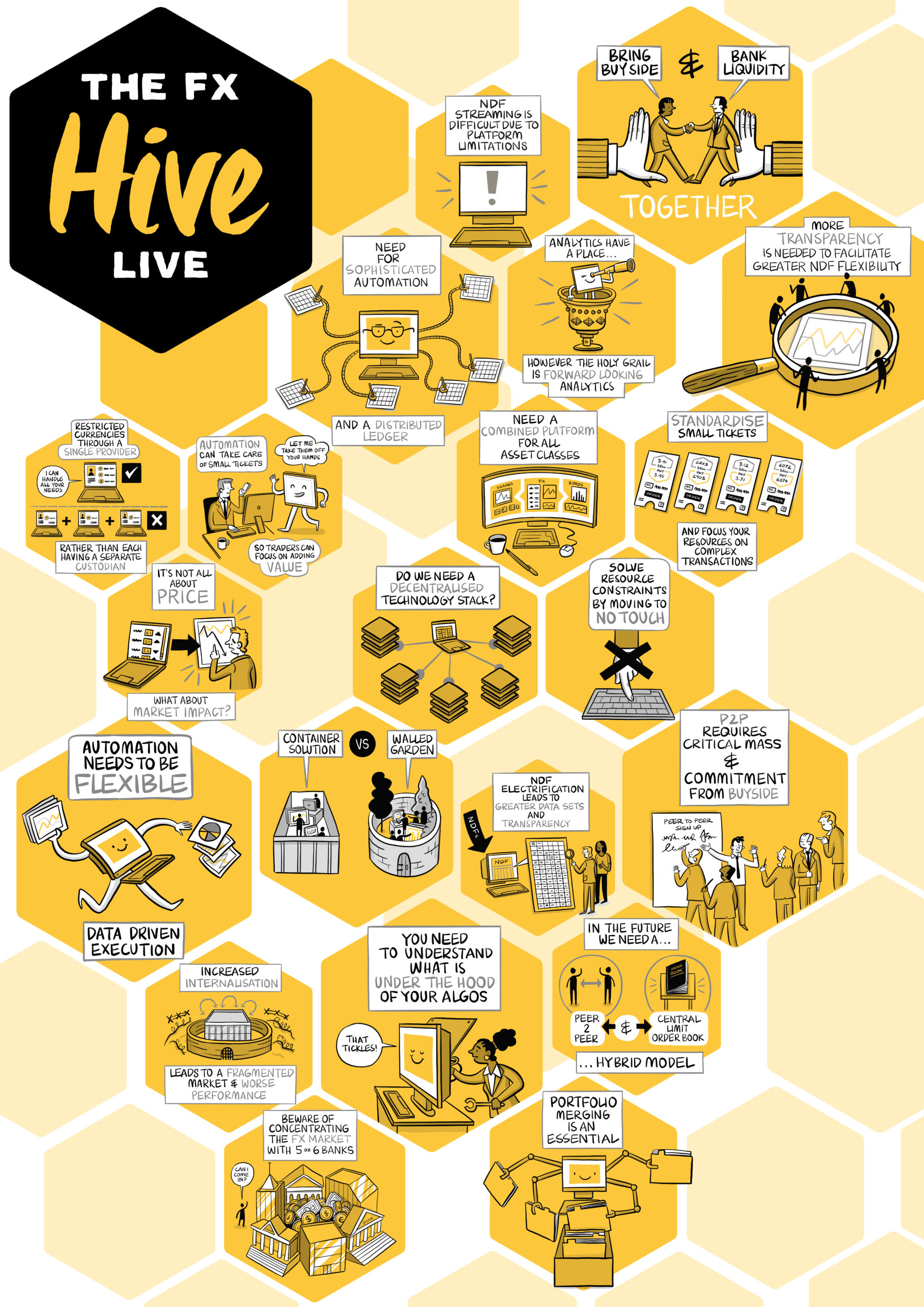

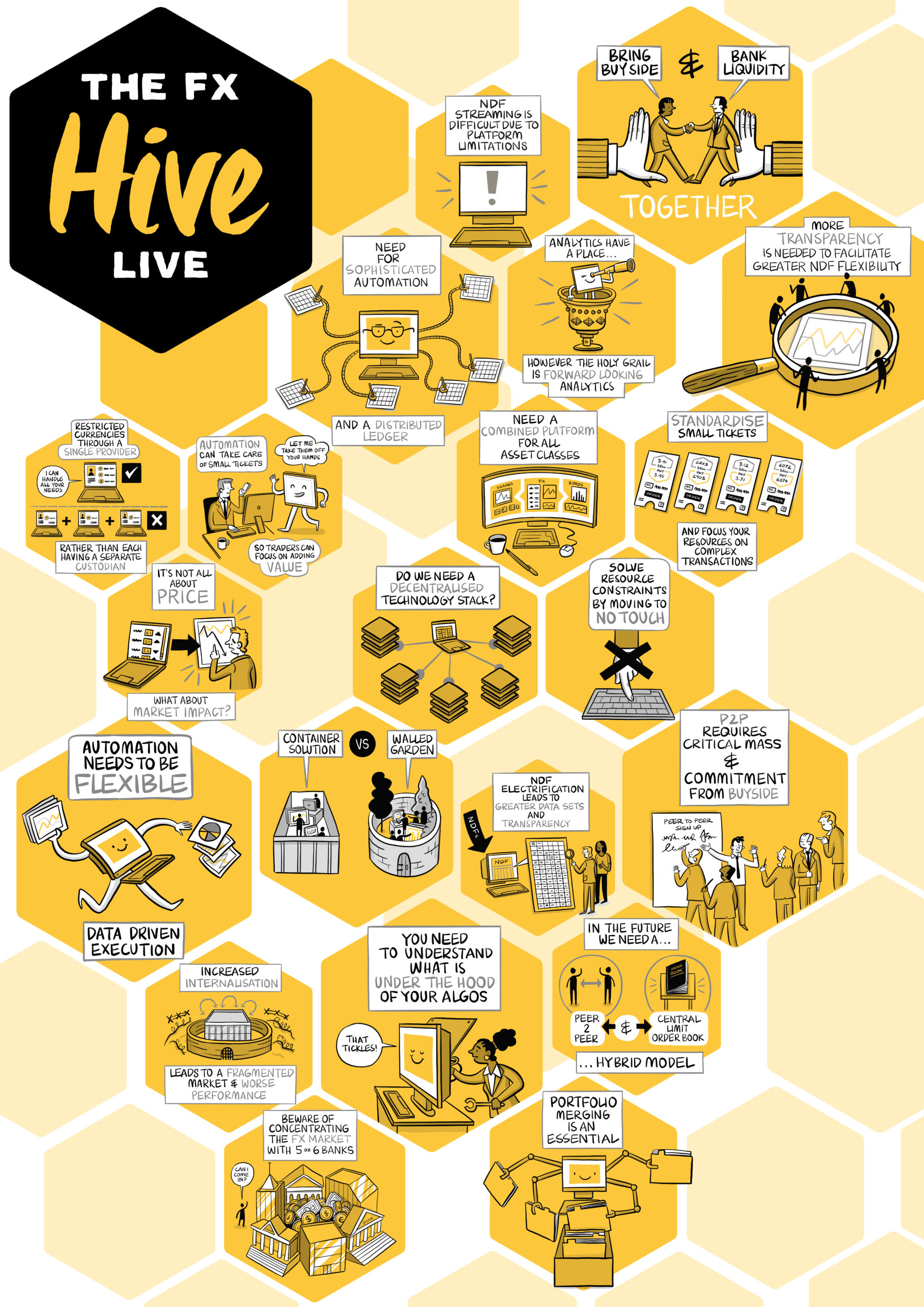

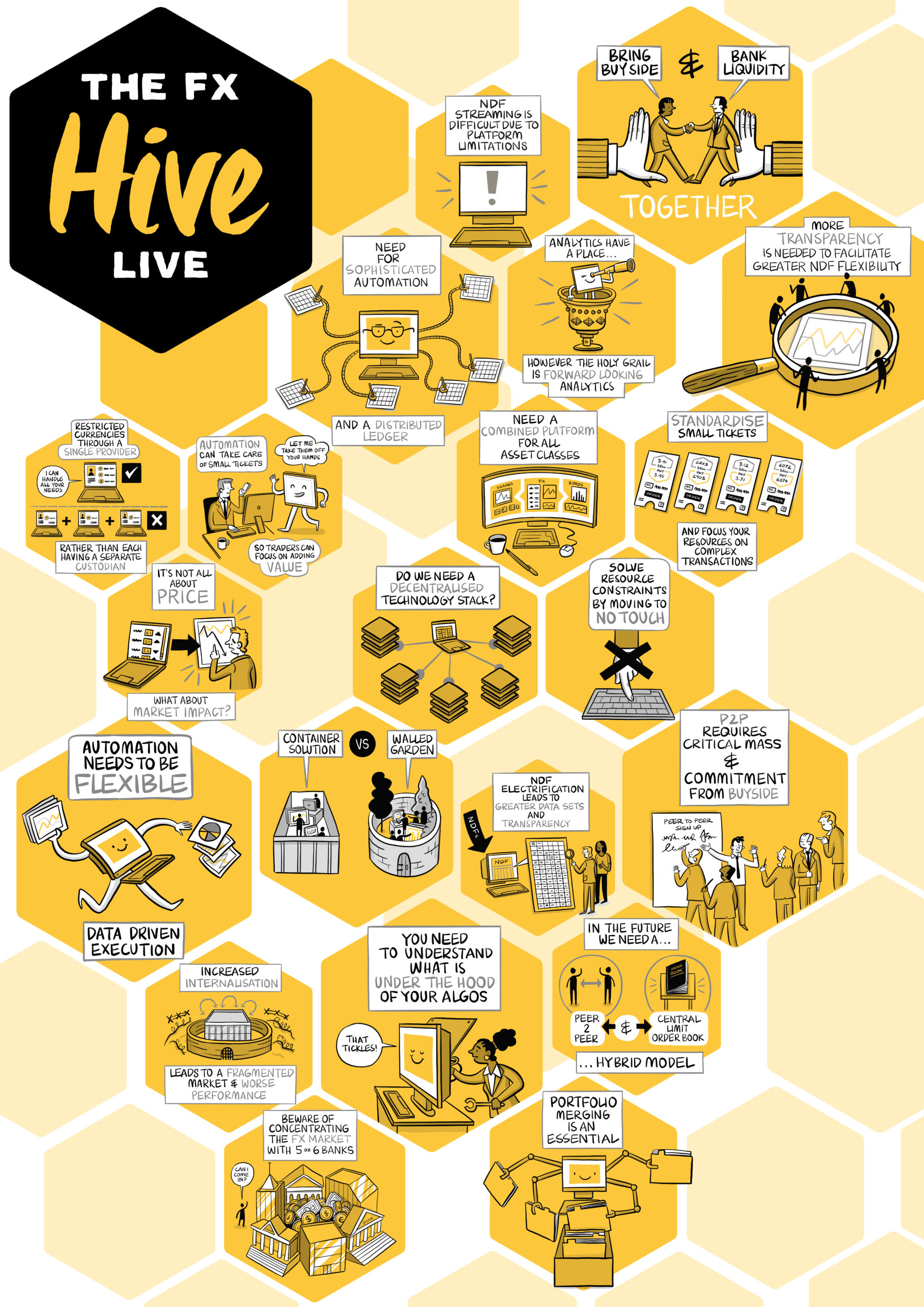

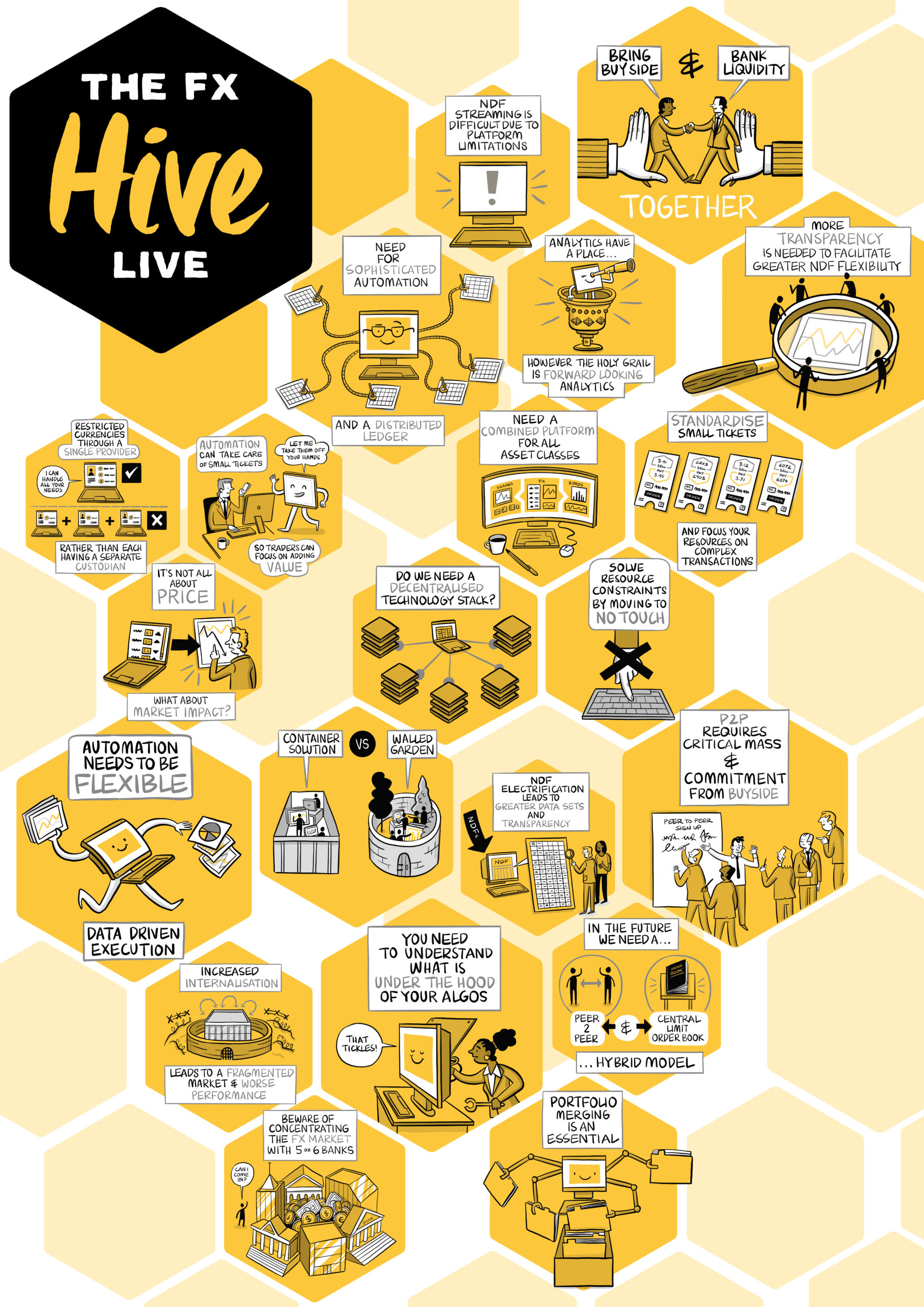

The FX Live Scribe

We recently ran our FX in-person meeting for our London based buy side community, looking into workflow & execution technology and desk structure & management efficiency. Some of the key discussion points, takeaways and photos from the sessions are captured below in the form of a scribe…