This month, our FX members came together for one of our monthly café sessions to discuss how heads of desk are making informed decisions on algo and broker panel selection through TCA, and assessing the merits of algo execution compared to other avenues of execution. For those that couldn’t join, we’ve summarised some of the key talking points below.

Implementation of Algos Across The Buy Side

From the discussion it was clear that levels of algo implementation amongst the buy side is not only determined by location and size of firm, but also by the asset class traded. For example, as previously known equity-focused firms are typically ahead of the curve in adopting algos compared to those that primarily trade fixed income or FX. Additionally, the level of adoption of algos is often linked to the availability of quality data. Firms that have invested in data infrastructure and analytics capabilities are better positioned to take advantage of the benefits of algos available on the market.

Algo Providers and Post-Trade TCA

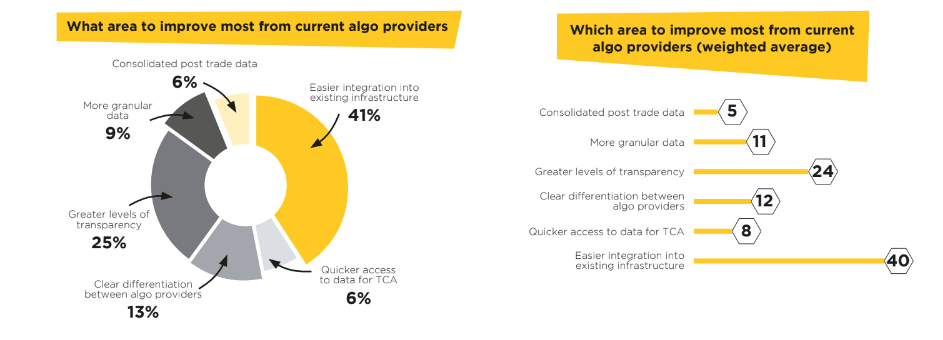

Members are finding that post-trade TCA provision with algo providers varies significantly. While some providers offer comprehensive TCA data, others fall short, and the quality of the data can impact the ability to measure execution quality accurately. Moreover, members are interested in knowing how well algos perform with crosses and if there are any differences in performance depending on the technique used. Providers that can offer high-quality TCA data across all aspects of the trade execution are likely to be favoured, but these are generally perceived as being few and far between.

Systematic Frameworks and Bank Pre-Trade TCA Tools

The use of systematic frameworks to determine algo usage is still evolving among members. While some firms have implemented systematic frameworks, others are leaving it at the discretion of the trader. The lack of standardised frameworks can lead to inconsistencies in the approach to algo usage. Overall, it seems that members are heading in the same direction to find a common set of algo types that they request from providers.

Members are looking at banks’ TCA tools as well as the algos themselves. Pre-trade TCA tools are seen as generally accurate, but post-trade TCA can be overly generous, making the numbers look good, but limiting the overall effectiveness of the trade. The challenge is finding the right balance between pre-trade and post-trade TCA to ensure that the best execution practices are followed, whilst enabling accurate reporting based on internal metrics and measurement requirements.

The Trade-Off Between Market and Liquidity Risk

Members recognise the trade-off between market and liquidity risk when it comes to executing trades using algos. To get the best results, traders must find a sweet spot between taking liquidity off the market and minimising market risk. Members at smaller firms are using data to identify which algos are better for different types of flows, currencies, and liquidity profiles. The role of trader intuition is also highlighted as essential in making the best decisions based on the information collected at the time of execution.

Conclusions

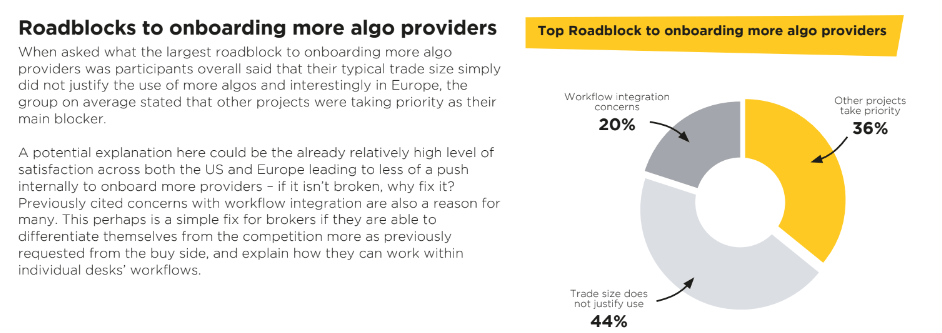

In conclusion, the adoption of algos among buy-side firms varies widely based on location, size, and asset class. Equity-focused firms are generally ahead of the curve in adopting algos, while smaller firms tend to use them less frequently. The use of systematic frameworks is still evolving, with some firms leaving the decision-making to traders. Algo providers vary in terms of the quality of their post-trade TCA, with members seeking comprehensive data to measure execution quality accurately. FX algos are used by some members, but the nature of their trades can limit their usage. The trade-off between market and liquidity risk is also a significant consideration in executing trades with algos. Finally, members are looking at banks’ TCA tools as well as the algos themselves to ensure best execution practices are followed.

For a much more detailed look at buy side algo usage, as well as EMS and automation capabilities across Europe and the US why not read our recent pulse report in collaboration with Bloomberg which focuses on algos becoming a vital part of trader workflows?

Or, interested in having this conversation in-person? We’ll be hosting an additional Solution Spotlight at our upcoming North American FX Leaders Residential. Click on the link below to find out more…